maricopa county irs tax liens

Ad Use our tax forgiveness calculator to estimate potential relief available. How does a tax lien sale work.

Maricopa County AZ currently has 18173 tax liens available as of September 3.

. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax. See Available Property Records Liens Owner Info More. Search For Maricopa County Online Property Liens Info From 2022.

When a Maricopa County AZ tax lien is issued for unpaid past due balances Maricopa County AZ creates a tax-lien certificate that includes the amount of. Directing the Maricopa County Arizona Treasurer to execute and deliver to the purchaser of the Maricopa County Arizona tax lien certificate in whose favor the judgment is entered including. Find All The Assessment Information You Need Here.

Centralized Lien Operation To resolve basic and routine lien issues. Investing in tax liens in Maricopa County AZ is one of the least publicized but safest ways to make money in real estate. Based On Circumstances You May Already Qualify For Tax Relief.

The Maricopa County Treasurers Tax Lien Web application allows you to monitor your CP Buyer account with Maricopa County. The IRS a bureau within the US. Free Case Review Begin Online.

The Maricopa County Treasurers Office does not guarantee the positional accuracy of the Assessors parcel boundaries displayed on the map. Ad Unsure Of The Value Of Your Property. Search Any Address 2.

The Tax Lien Sale will be held on February 9. All groups and messages. In fact the rate of return on property tax liens investments in.

Maricopa County IRS Offices are local branch locations of the Taxpayer Assistance Center of the Internal Revenue Service IRS in Maricopa County AZ. Ad Search Information On Liens Possible Owners Location Estimated Value Comps More. Applying to the IRS for a Lien Discharge or Subordination The Segment 1 video for the federal tax lien discharge and subordination process introduces the topic and.

Search For Maricopa County Online Property Liens Info From 2022. Nonetheless if the federal government does not seek to enforce a tax lien in Maricopa County Arizona within 10 years of imposing it federal law dictates that the lien automatically expires. Tax Department The Arizona Tax Department was established in September 1988 and has jurisdiction over disputes anywhere in the state that involves the imposition assessment or.

Ad Find Anyones Tax Lien Records. Enter Name Search Risk Free. Type Any Name Search Risk-Free.

Ad Unsure Of The Value Of Your Property. Download the Previously Offered Tax Deeded Land - NOT SOLD PDF. For additional information on Tax Deeded Land Sales you may contact the Treasurers Office at.

Verify a lien request lien payoff amount or release a lien call 800-913-6050 or e-fax 855-390-3530. Fast Easy Access To Millions Of Records. Find All The Assessment Information You Need Here.

Ad See Anyones Public Records All States. Ad See If You Qualify For IRS Fresh Start Program. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems.

Response To Petition For Legal Separation With Children Drlsc31f Pdf Fpdf Docx

The Essential List Of Tax Lien Certificate States

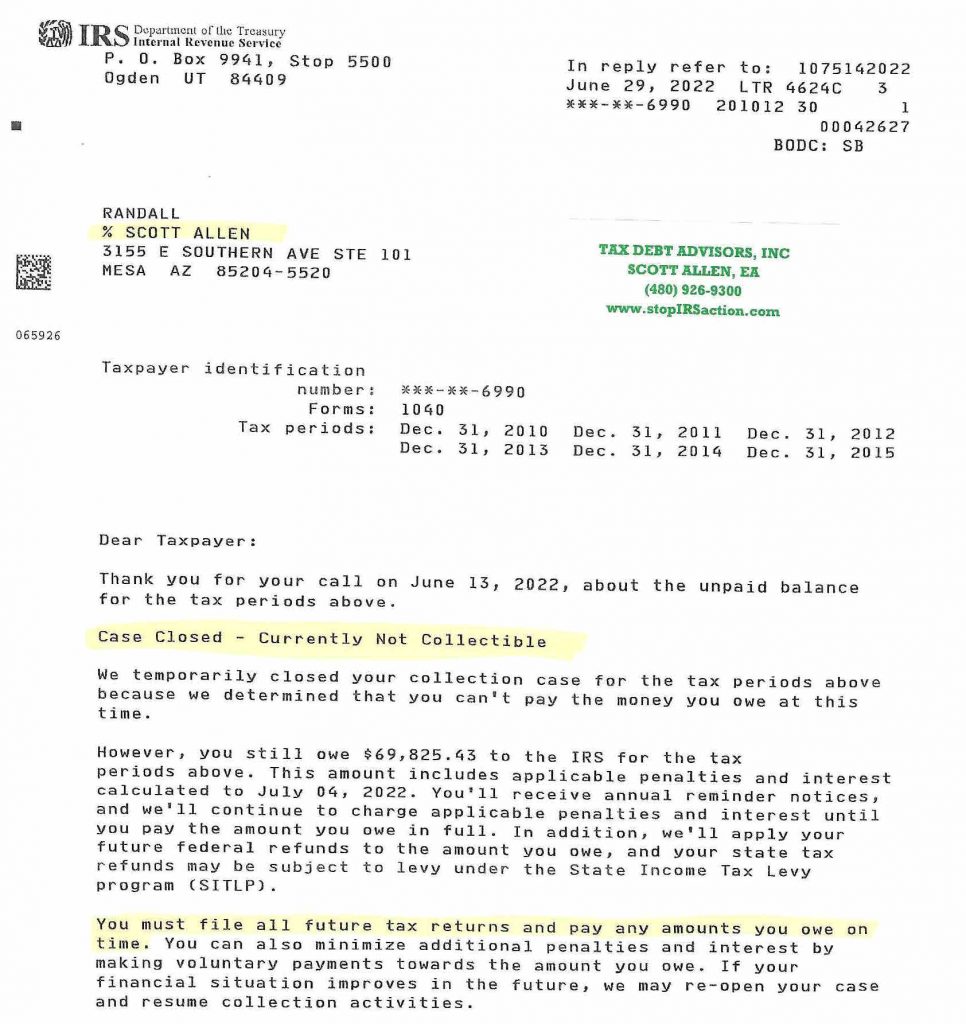

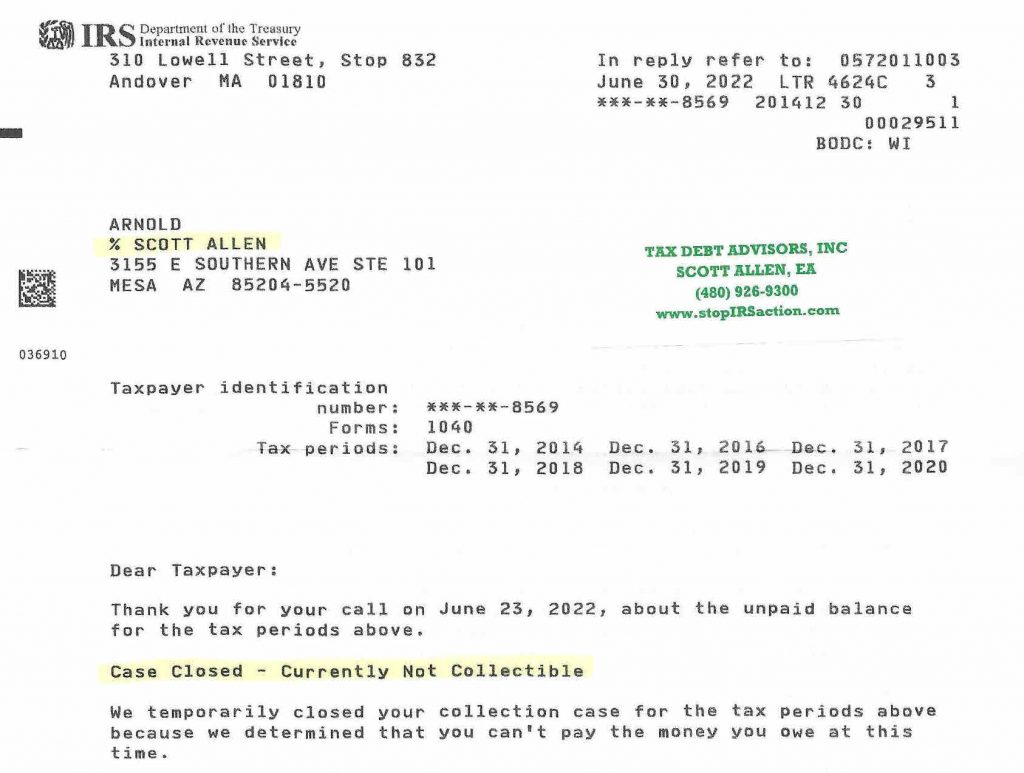

Unfiled Tax Returns Tax Debt Advisors

Who Rents And Who Owns In The U S Pew Research Center

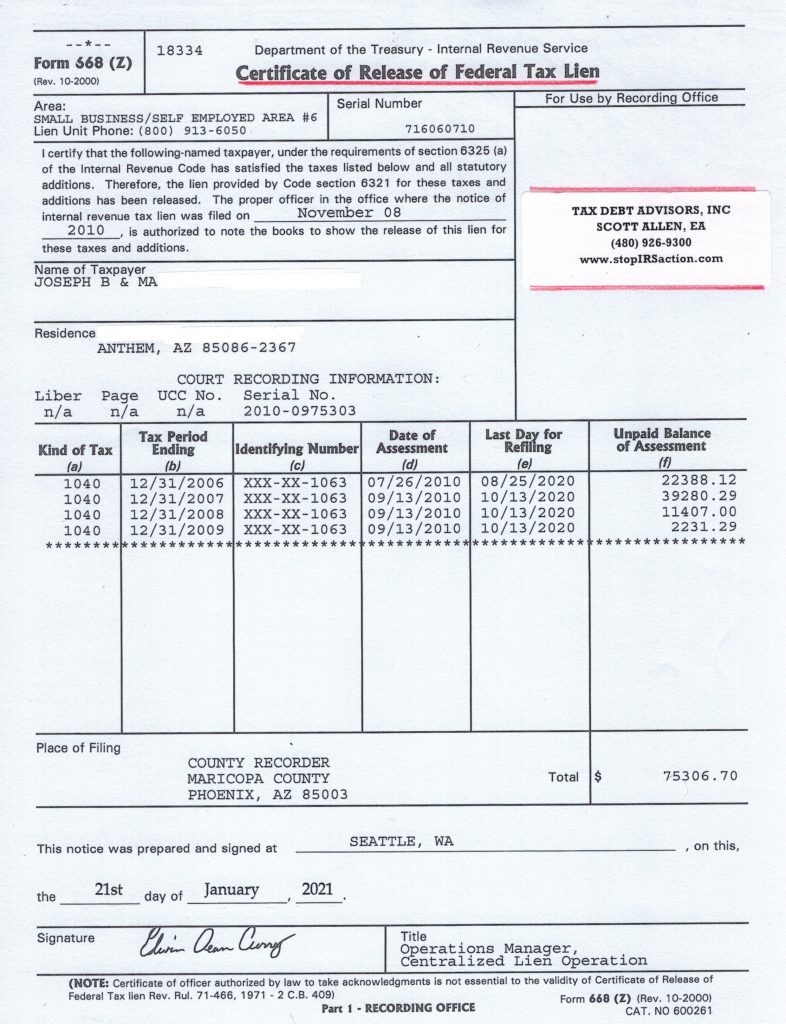

Irs Tax Lien In Arizona Irs Help From Tax Debt Advisors Inc Tax Debt Advisors

Arizona Poised To Move To A Flat Tax Rate Beachfleischman Cpas

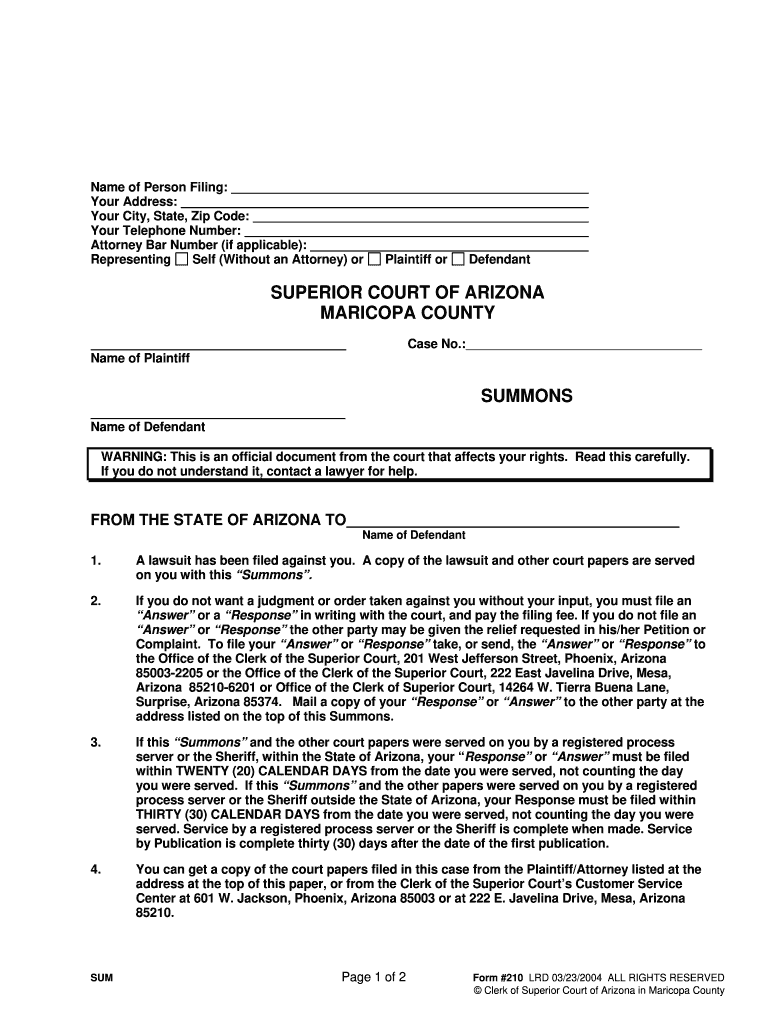

Fillable Online Clerkofcourt Maricopa Maricopa County Summons Form Fax Email Print Pdffiller

Irs Tax Lien Problems Tax Debt Advisors

Pin By Sun City Home Owners Associati On Schoa Sun City Arizona House Styles Mansions

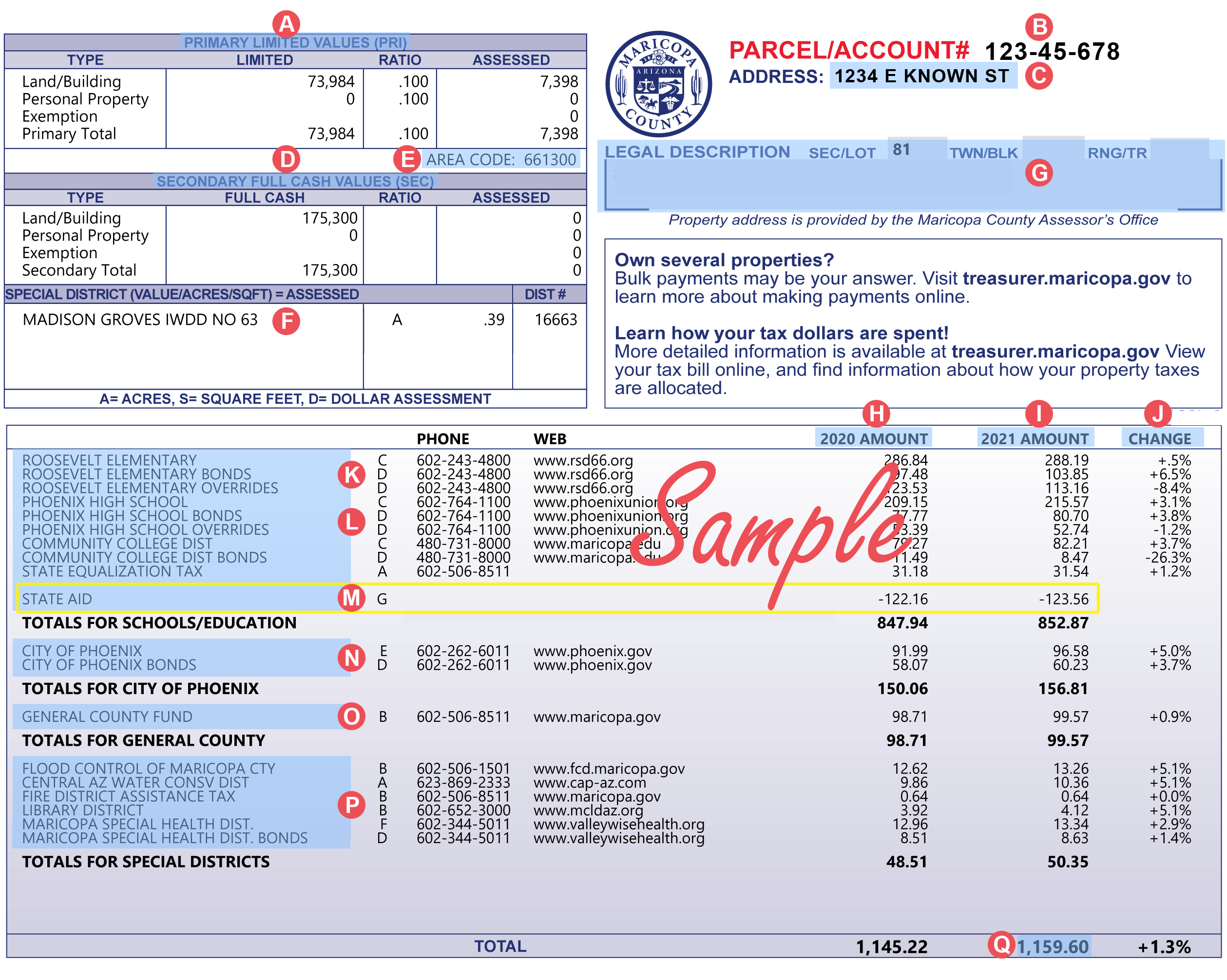

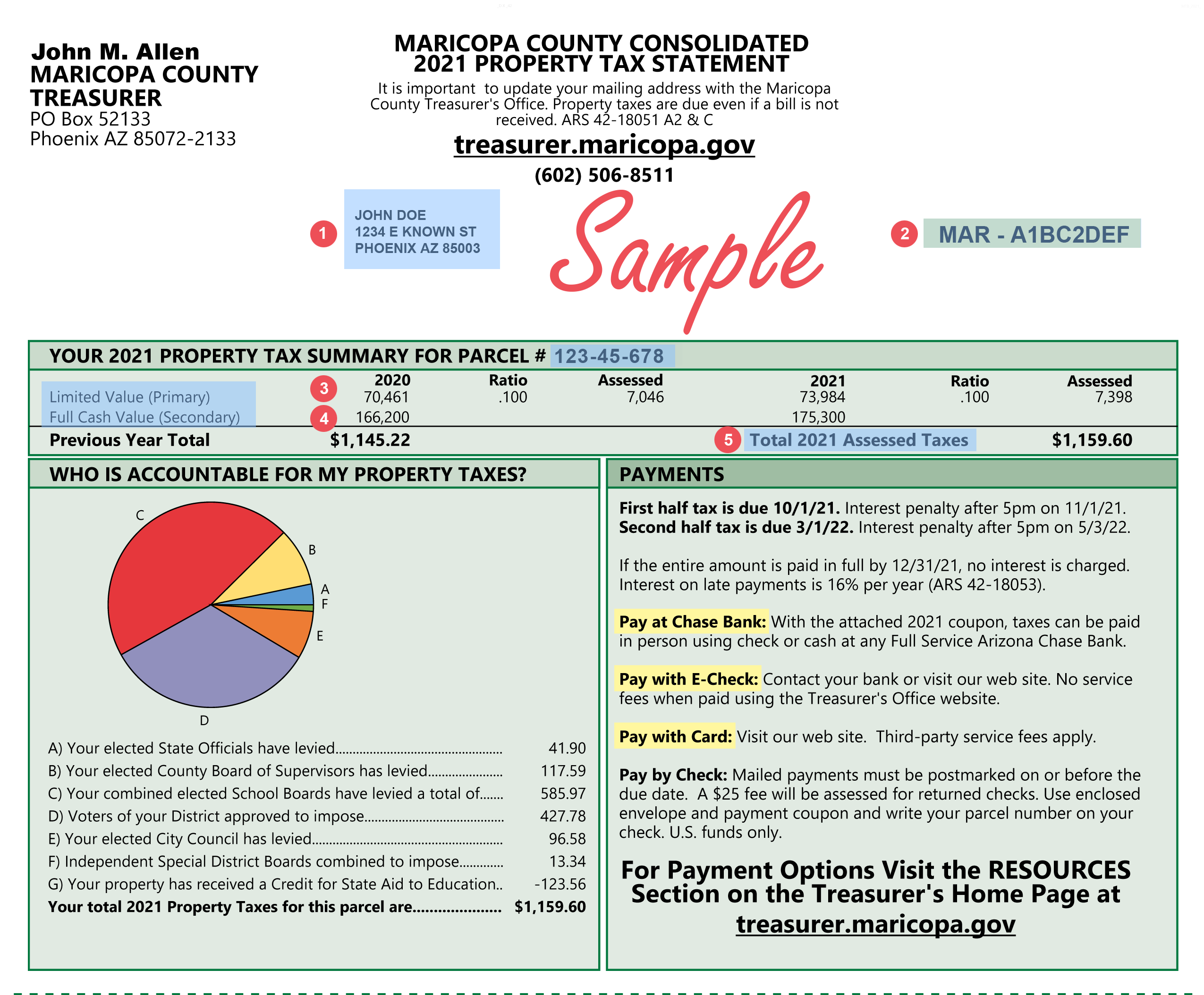

An Interview With The Maricopa County Treasurer Asreb

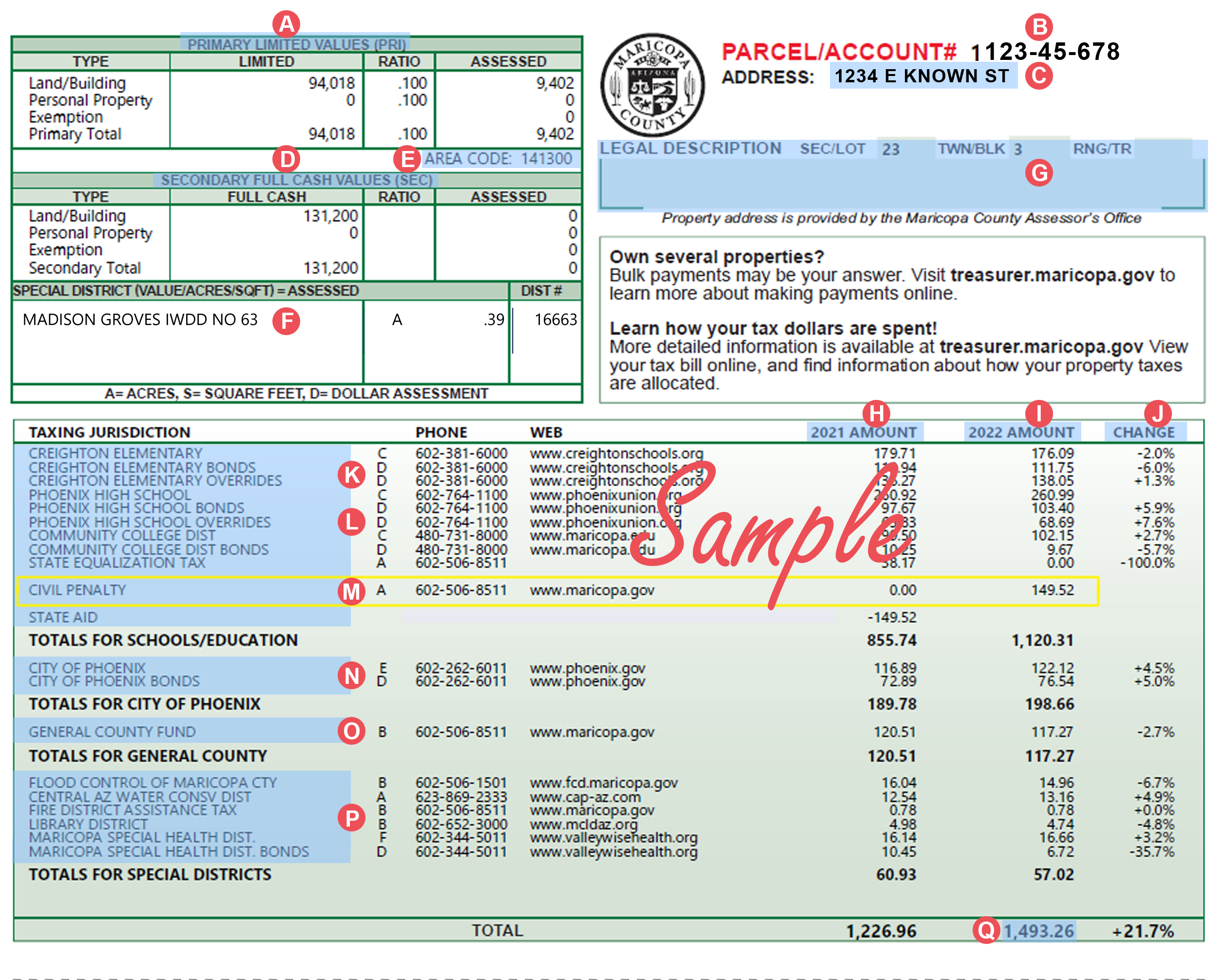

The Basics Of Tax Liens Arizona School Of Real Estate And Business

Hurf And Vlt Distributions To Pima County Reach Record Breaking Levels Arizona Daily Independent

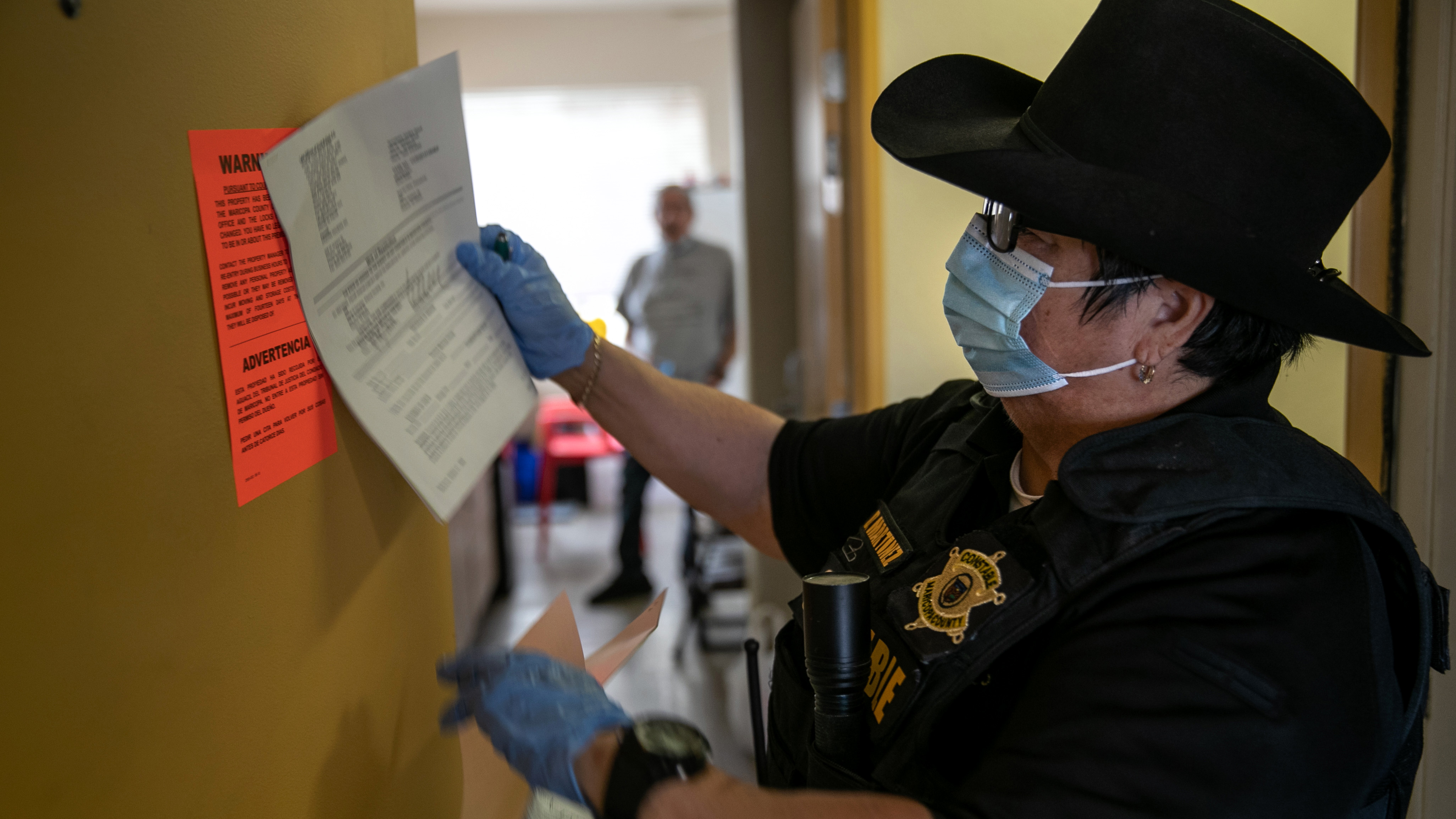

Foreclosure Of Association S Assessment Lien And Tax Liens Hoa Lawyer